I can’t believe we are wrapping up the first quarter of 2024 already. Where does time go?

We had a great industry-focused event in Washington, D.C., in February, our annual Beyond the Beltway, and have announced an education-focused virtual version on March 27, Beyond the Curriculum. This event is complimentary to you as we kick off our first edu-focused version of this highly anticipated event. I will share an education market update, so I hope to see you there!

This month, I want to share a few market and technology updates for the year ahead. From budgets hitting pre-pandemic levels to identifying where government will need your services most this year, there’s a lot to unpack, so let’s get started.

Economic Update: The Big Picture

Much of the spending from the one-time federal stimulus funding is coming to an end later this year. We've seen those rapid, one-time increases in spending with a rise in housing prices and shifts in consumer spending.

- State and local budgets are getting some padding, and we are seeing budgets normalize and go back to pre-pandemic levels.

A few things to watch for in the public sector:

- Workforce challenges are persisting, with high voluntary job departure rates pressuring existing staff and operations.

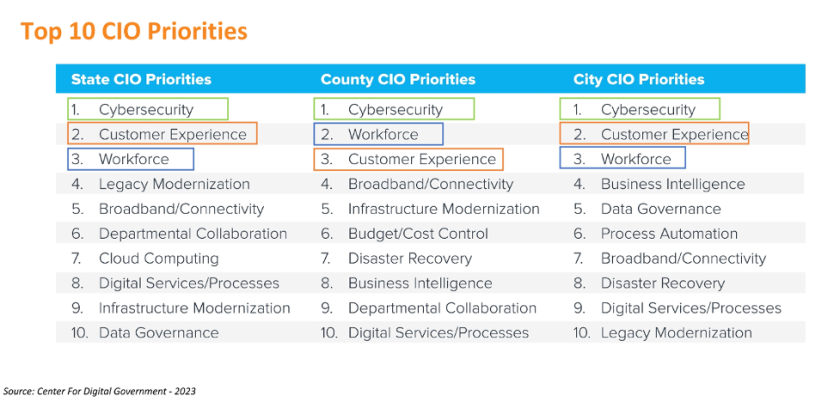

- Workforce is a top priority for state, county and city CIOs, as shown in the image below.

- Technology investments are anticipated to increase as solutions for automation and efficiency are needed.

- Election outcomes may alter the public-sector landscape, potentially affecting policy and tech-related opportunities.

- AI and tech advancements present both opportunities and procurement challenges within the public sector.

Resources for You

On-Demand Webinar: I hosted a webinar last week on how intent data can help you uncover hot spots in the market and find conversational door openers with your customers. Read this quick recap to uncover the power of spotting state and local IT deals early by using the Intent Insights feature in GovTech Navigator.

Get Ahead of the RFP: Speaking of spotting deals early, here is a resource that explains how our team delivers early-stage tech projects to you through Developing Opportunities.

Opt-In SLED Leads: The team put together this new article, "Quality vs. Quantity: The Opt-In Advantage and SLED Leads," to show the benefits of leveraging opt-in experiences to generate public-sector leads and share how this tactic can significantly impact your sales and marketing.

As always, reach out with any questions by responding to this email. Connect with me on LinkedIn here.

See you next month!

Subscribe to our Market Insights newsletter here.